The German tax system is a complex subject that many people find difficult to understand. However, there is no need to worry as the process of calculating the tax refund is relatively simple if you know the right steps to follow.

If you think you are entitled to a tax refund, there are some important pieces of information you need to know. First, you must properly complete and file your tax return. If you don’t have experience with tax returns, you can contact a tax consultant to help you with this process.

Another important piece of information you need to calculate your tax refund is the tax bracket you are in. Depending on your tax bracket, you may be eligible for certain deductions and tax breaks that can reduce your tax burden and increase your tax refund.

Once you have gathered all the necessary information, you can go ahead and calculate your tax refund. In this article, we will explain the steps needed to calculate the tax refund and give you tips on how to maximize the amount.

With this knowledge, you can calculate and claim your tax refund. We wish you good luck!

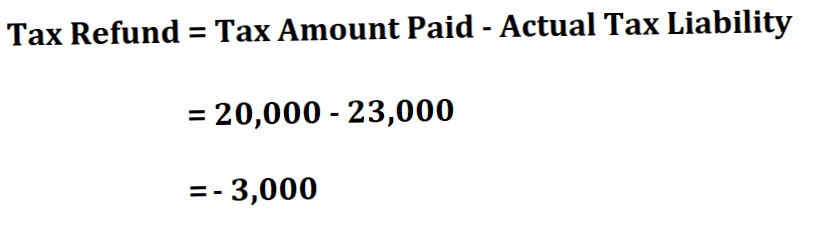

How to calculate the tax refund?

The tax refund is calculated by comparing the taxes you paid to the deductible expenses you incurred. In this context, income-related expenses, special expenses and extraordinary burdens are of particular importance. These can be claimed in the tax return and thus reduce the taxes payable.

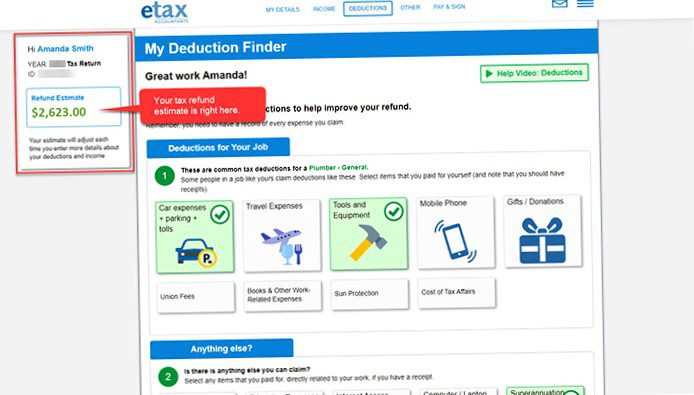

To make a more accurate calculation, you can use free online tax calculators. These allow you to enter your individual data and get an accurate estimate of the tax refund. It is also advisable to ask the tax office for a preliminary tax calculation to ensure that you do not have to pay any back taxes.

It is important to fill out a careful tax return in order to be able to declare all relevant expenses. Avoidable errors and incompleteness can result in the tax refund being lower than expected. Therefore, the forms should be filled out and checked thoroughly to avoid unpleasant surprises.

- If you fill out your tax return yourself, you should be sufficiently informed and, if necessary, seek help from a tax advisor.

- Even small expenses can be deductible. Therefore, all documents, such as receipts, should be retained.

- If you have changed your residence or started a new job during the tax year, it is especially important to include all relevant information correctly on your tax return.

Review of the tax assessment

Once you have filed your tax return, you will receive a tax assessment from your tax office. It is important to check this notice carefully to ensure that all details are correct. In particular, you should ensure that all listings and calculations have been made correctly.

If you have doubts or have the impression that there are errors, you should not hesitate and act quickly. You have the opportunity to appeal within four weeks of receiving the tax assessment notice. If necessary, you should seek advice from a tax advisor or income tax assistance association here.

However, if you do not find any error and everything has been calculated correctly, you can look forward to a possible tax refund. The amount of the tax refund depends on many factors, such as your income, income-related expenses and tax bracket.

- Expect a higher tax refund if you have claimed a lot of income-related expenses.

- However, if you are in a higher tax bracket, the tax refund is often lower.

It is advisable to calculate the tax refund using a tax calculator on the Internet to get an approximate idea and avoid possible surprises. Note, however, that these calculations are only an estimate and you should not rely solely on them.

Deduction of income-related expenses and calculation of tax refund

If you, as an employee, have expenses that are directly related to your job, you can claim them as income-related expenses on your tax return. These include e.g. Travel expenses, work supplies or training costs. You can deduct these from your gross income and thus reduce your tax burden. But how to calculate the possible tax refund?

First, you must list and substantiate all income-related expenses in your tax return. These will then be reviewed by the tax office and recognized if applicable. Then your taxable income is calculated by deducting from your gross income the income-related expenses and other deductions such as e.g. the social security contributions are deducted.

The amount of tax is then calculated from the taxable income and the corresponding tax rate. This tax is deducted from the payroll tax already withheld. If the calculated tax is lower than the withheld income tax, you will receive a tax refund.

It is therefore worthwhile to include all relevant income-related expenses in your tax return in order to reduce a potential tax burden and receive a higher tax refund. Careful documentation and collection of receipts is important in order to facilitate recognition by the tax office.

The calculation of the tax refund

If you want to receive a tax refund, be sure to consider special expenses. For example, you can deduct expenses for certain insurances or donations to charitable organizations from your taxes. It is important to keep the relevant receipts and proofs carefully in order to be able to present them in case of an audit.

In order to calculate the amount of your tax refund, it is advisable to file a tax return. You declare all relevant income and expenses and the tax office checks whether you are entitled to a refund. When calculating the tax refund, it is important to keep in mind that there are several factors that can influence it. This includes, among other things, the amount of taxable income and the number of children you have.

- An important tool for calculating the tax refund is the so-called tax calculator. This can give you an indication of how much your refund is likely to be.

- However, it is advisable to have the calculation checked by a tax advisor or income tax assistance association to ensure that you have exhausted all possibilities for tax savings.

- In summary, the consideration of special expenses is an important factor in the calculation of the tax refund. Detail all relevant expenses on your tax return and have them reviewed by an expert, if necessary, to obtain the best possible refund amount.

Summary

If you pay taxes in Germany, you may be entitled to a tax refund. The amount you get back depends on several factors, including your income, tax bracket and expenses.

To calculate your tax refund, you must first file your income tax return. This provides information about how much income tax you paid last year. If you had tax deductions or expenses, you can report them on your tax return and potentially reduce your tax burden.

There are several tools and online systems that can help you calculate your tax refund. However, if you are unsure how to calculate a tax refund, it is best to consult a tax advisor. A professional tax advisor can help you fill out all the necessary forms and make sure you take advantage of all possible tax benefits.

- File your income tax return.

- Include tax deductions and expenses.

- Use online tools or consult a tax advisor to calculate your tax refund.

By filing for a tax refund, you may be able to get a significant amount of money back. Use all available resources to make sure you don’t pay more taxes than necessary.