When financing new construction projects, builders usually have to dig deep into their pockets and raise large sums of capital. However, the required funds cannot always be raised in sufficient amounts. This is precisely where mezzanine capital providers come into play, offering an interesting alternative to conventional financing options.

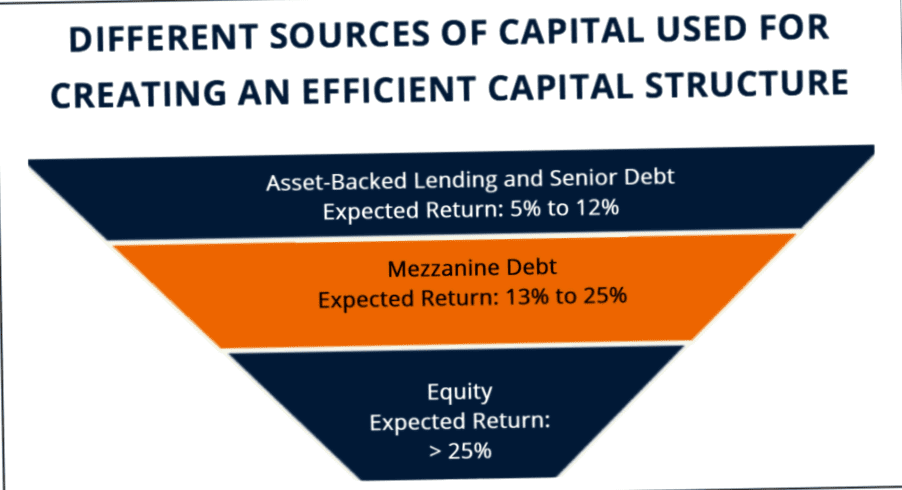

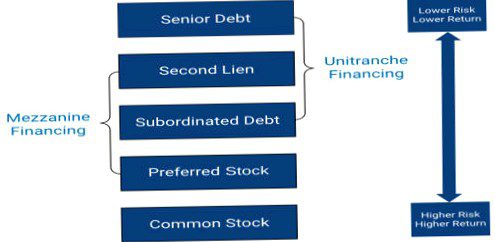

Mezzanine capital is a form of financing that is a mixture of equity and debt capital. This capital is positioned between the classic forms of debt and equity financing and is thus a type of interim financing.

Particularly for new construction projects, mezzanine capital can be an alternative to pure equity or debt financing. This is because the use of mezzanine capital can structurally improve the capital structure of a new construction project. Building owners thus have the opportunity to implement their project with less equity and without additional borrowed capital.

The following section examines the advantages and disadvantages of mezzanine capital in new construction projects and shows why this form of financing will continue to gain importance in the future.

What is mezzanine capital?

Mezzanine capital is a type of financing that lies between equity and debt capital. It is a mix of debt and equity instruments typically used in companies and projects to improve the capital structure.

In the context of new construction projects, mezzanine capital can be used to meet capital needs that exceed the traditional bank loan. This could be required, for example, for the acquisition of land, the development of construction plans or the implementation of construction measures.

The use of mezzanine capital as a construction financing option offers the potential for a structural improvement in the capital structure of the project. Introducing mezzanine capital as a hybrid of equity and debt can reduce the cost of equity and increase the flexibility of repayment.

The risk for mezzanine capital providers is generally higher than for traditional debt providers, as this form of financing ranks after traditional debt in the order of demands but after equity capital. As a result, higher interest rates or fees are typically charged.

Nevertheless, mezzanine capital can be an attractive option to deal with construction financing and capital structuring, especially when financing cannot be covered by traditional bank loans alone.

Advantages of mezzanine capital in new construction projects

Various sources of financing are required when financing new construction projects. Mezzanine capital is a popular form of financing. This is a form of business financing in which the capital is between equity and borrowed capital.

Structural improvement of the capital structure in new construction projects is one of the biggest advantages of mezzanine capital. This form of financing offers investors a higher return than traditional loan financing, while the project has a higher equity ratio.

Another advantage of mezzanine capital is that it does not require a collateral package from investors. This is particularly beneficial for small and medium-sized companies, as they often have difficulty providing collateral.

- No contractual sale of company shares

- Flexibility in repayment that can be matched with the company and the project

- Ability to raise fresh capital and expand the financing structure

Due to the many advantages offered by mezzanine capital for new construction projects, it is becoming an increasingly popular form of financing. By structurally improving the capital structure, the project can become more profitable and have a higher equity ratio. In addition, mezzanine capital is a flexible form of financing that can be adapted to the company and the project.

The risks of mezzanine capital in new construction projects

Structural improvement of the capital structure through mezzanine capital in new construction projects can offer many advantages. But there are also risks that should not be ignored.

One of the biggest risks is the dependence on mezzanine capital providers. Since these investors often seek a higher return, they can put pressure on the company to represent their interests. This can result in the company being forced to make decisions that affect the long-term success of the project.

Other risks are that mezzanine capital is usually more expensive than conventional forms of financing such as bank loans. In addition, companies often have to pay high interest rates when repaying the mezzanine capital.

Overall, it is important that companies using mezzanine capital understand the risks involved and build processes to minimize those risks. Proper risk assessment and management can help ensure that the project is completed successfully and that no unexpected problems arise.

Summary:

- Dependence on mezzanine capital providers

- Pressure on the company to make decisions that affect its long-term success

- Higher cost compared to traditional financing methods

- High interest rates on repayment of mezzanine capital

- Need for appropriate risk assessment and management

Mezzanine capital in new construction projects

Financing new construction projects can be a major challenge for builders and project developers. One way to improve the capital structure is to raise mezzanine capital. This is debt capital similar to equity, which is positioned between equity and classic debt capital. Mezzanine capital can enable a structural improvement of the capital structure by e.g. Optimizes the ratio of equity to debt, thereby also reducing interest costs.

Another advantage of mezzanine capital is that it can often be structured more flexibly than traditional debt capital. For example, repayment terms and maturities can be individually adjusted. This can better accommodate the needs of the project developer and create room for an adaptable financing strategy.

However, raising mezzanine capital typically involves higher costs than traditional debt capital. It is also a riskier investment for many lenders, as it is serviced after traditional debt in the capital structure ranking. It is therefore important that builders and project developers inform themselves in advance about the advantages and disadvantages of mezzanine capital and carry out a careful calculation.

- Mezzanine capital can be used to optimize the capital structure of new construction projects

- Mezzanine capital can be structured more flexibly than classic debt capital

- Raising mezzanine capital is associated with higher costs

- Mezzanine capital is riskier for lenders than conventional debt capital